The Power of Payroll in Your Catholic Organization

By Mary Stange

Client Advisor

Power of Payroll

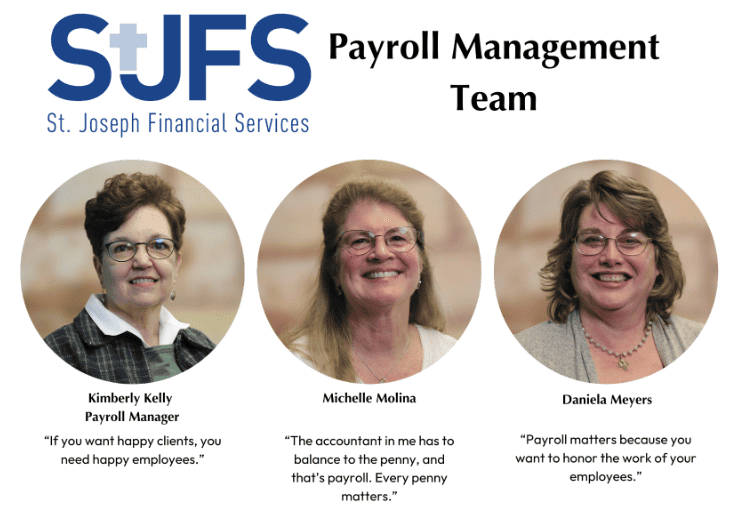

Confidence in your Payroll Process is a fundamental building block for employee retention. “If you mess up an employee’s payroll once or twice, you stand a good chance of losing employees.” Kimberly Kelly, Payroll Manager stated, when reflecting on retention statistics. St. Joseph Financial Services’ Payroll Management offers a one-stop-shop for your accounting and payroll services. Our experienced Payroll Team is here to support your mission through the work of payroll. This qualified team makes it their mission to give you the time and availability to focus on your mission.

“We offer a great team, with valuable years of payroll experience and Michelle and Daniella bring accounting experience as well. Knowing Catholic entities, as well as their structure, is a big piece of what we offer. We know the difference between a lay employee and a member of the clergy or of a religious order. We can speak the language of the Church. You don’t have to try to educate your payroll provider, because we are already familiar with that sphere. This experience enlivens the work of the Payroll Management Team assembled here at St. Joseph Financial Services.” Kimberly extolled.

“We recently had an employee use Family Medical Leave for an operation. Unfortunately, the rest of his accrued paid time off was wiped out in the process, which is not the point of Family Medical Leave. We wanted him to be able to carry his accrued hours forward into this year. So we worked to correct this error. They were incredibly grateful for the attention to detail,” Daniella Meyers remarked on the impact of their work.

Payroll Compliance

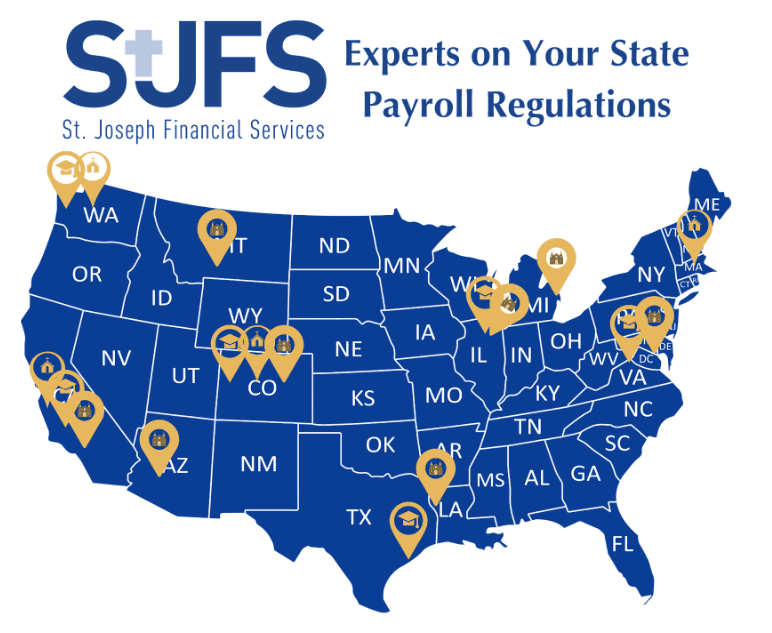

As a national firm, our team makes it a priority to be an expert on your state’s payroll rules and regulations. “We have several clients in Colorado who weren’t aware of a Colorado mandate that employers provide a retirement savings vehicle. We offered them resources to find an affordable plan and to become compliant with the State’s regulation,” Kimberly shared. One of our partner companies, Gusto, offers competitive retirement programs that easily integrate with their payroll system. This adds value to the employee and protects the employer from state penalties.

In another instance Kimberly recollected, “A client came to us from another company and was brand new in her position. When we found out that their 401k was linked to their previous provider, we were able to find them an alternative that met their guidelines. We also took the time to help her understand the workflows, tax registrations across states for the company, worker’s compensation and unemployment filings. Now she trusts us as a resource for tools through Gusto.”

Payroll Practices

It is not terribly expensive to switch payroll providers. Between most of our offered platforms with Human Capital Management (HCM), the investment includes time keeping as well as payroll. Additionally, the fee structures are dependent on the number of employees on staff. Finding providers who don’t charge by payroll run provides a big savings and more freedom for any necessary corrections or adjustments. These corrections no longer need to be held over into a new payroll, a practice that can add stress to the employee as well as to the staff member tracking those instances. Not only this, but our staff is available to help with the company and employee setup, so there are no additional implementation costs.

Our systems securely store employee paperwork for you. This integration is available through offered onboarding suites. Even if you don’t need the applicant tracking features, employees receive a request to self-on-board, which allows them to complete and store their tax documentation.

The platforms we offer, can be built out to fit your specific needs. Salaried employees require a final review and approval before submission. The time keeping happens in the payroll platform, reducing instances of discrepancies. The only errors would be if an employee forgot to clock their time, which can be caught in the review prior to approval by your on-site staff. The real burden relieved is the need to find a qualified staff member to take on the intricacies of payroll. Qualified staff is within reach through St. Joseph Financial Services.