Proactive Tips for Your Catholic Organization’s Calendar Year End

Mary Stange, Client Advisor

St. Joseph Financial Services – stjfs.org

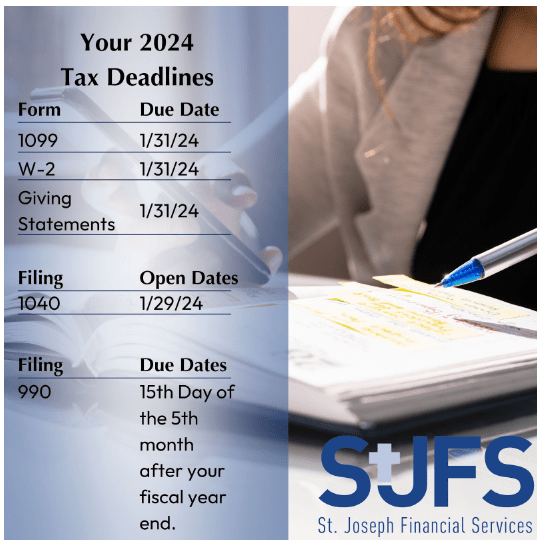

With the closing of a calendar year, we all look toward the filing deadlines and compilation of those documents necessary for our staff and our contractors. Most of our clients employ staff who fall into one of two categories; employed and contracted workers. Additionally, at the end of the year, any organizations who receive donations must compile and send out Giving Statements to their donors.

Employees

Our W-2 employees are those who are formally employed by your parish or school and for whom tax deductions are withheld based on their W-4. It is important to do a full review of withholdings for your employees as well as any tax filings. If you outsource your payroll, it is still prudent to check in with them to ensure that a review is taking place. Tying out withholdings totals for each quarter to Form 941 submissions. Additionally, tying out Unemployment figures to Form UI 3/40. Quarterly submission due dates are April 30, July 31, October 31 and January 31. It is important to review these tax submissions and tie out the figures to your payroll reports, in order to ensure that all payroll figures are accurate. This averts the risk of needing to run an adjusted W-2. The better versed you are on your employee’s withholdings and tax requirements the better equipped you are to answer questions that come in from your employees once they receive their W-2. The deadline for ensuring your employees have their W-2 in hand is January 31. Of note, though, is that the IRS is opening their Tax Filing for personal returns on January 29, 2024, ahead of the due date for W-2 delivery. Should an employee call to ask about this, it is a good practice to have your policies in writing for your office staff to use in these situations. Did you know that St. Joseph Financial Services offers a Payroll service? Shoot us an e-mail (info@stjfs.org) for more specifics.

Contractors

Our 1099 employees are those contractors who are not formally employed by your parish or school and whose services amass $600 or more in revenue for a calendar year. The 1099 form is generated through the contractor’s submission of form W-9. With the deadline to ensure your contractors have their 1099 in hand by January 31, it’s important to review expenses for the calendar year as soon as you are able to in January. There are so many ways to get to your final list of contractors. As a general outline, if you ran your expense report, and exported it to excel you could filter the data and remove those expenses and companies that are excluded from the need for a 1099. Once you have your list of companies that should be included and the amount that was paid to them in the calendar year, the cutoff for creation of a 1099 is $600 or more.

| Excluded from form 1099 | ||

| Account Type |

|

|

| Cost Centers |

|

|

| Company Types |

|

|

| Included in form 1099 | ||

| Account Type |

|

|

| Cost Centers |

|

|

| Company Types |

|

|

Giving Statements

At the end of a calendar year, it is necessary for entities who receive donations to offer giving statements, these are due by January 31. The population of Giving Statements begins with your donation recording platform, and the work to ensure accuracy happens throughout the year. For example, part of parish life is that each Monday Morning, a set of trained volunteers assist the business manager or bookkeeper in accounting for the Sunday Collection. Most parishes offer a number of standard envelopes to help donors know what they are contributing towards. For example, Regular Giving, Donations toward Fuel, Donations toward Flowers, Donations toward Tuition Assistance, and Donations on Solemnities. Perhaps the trickiest solemnity donations revolve around Christmas Donations. It is not uncommon for parishes to continue seeing envelopes marked for the Christmas Donation well into the new year. It is important to have a cut-off date for reasonable back-dating of specified donations like the Christmas Donation. We recommend a cutoff date at the latest of January 20th each year. As with every accounting practice, there are checks and balances in place between your accounting software and your donation recording platform. Any discrepancies discovered through the bank need to be appropriately looked into and corrected in the giving software and the overall total, updated. Donation figures should tie-out and close on a regular basis. With regular giving platforms in mind, business managers should run their Giving Statements. Additional accounts to take into consideration and include in a Giving Statement would be Specified Donations, Capital Campaigns, and Restricted Donations. Donations made to the Diocesan Annual Appeal should be receiving a Giving Statement from the Diocese. Even with all of the checks and balances in place, there are always those who offer input on their giving statement. Having a formalized outline for included funds and deadlines for reasonable back-dating can help equip your office staff to engage donors who have questions.