Planning Salary Increases at Your Catholic School

By Mary Stange; Client Advisor

It’s not Too Early

Reviewing current salaries, and planning for salary increases, should be part of the budget meetings held by Finance Councils at this time of year. Truly, in tandem with the setting of Tuition. One of the things to celebrate with your local school are the skills and talents of your Finance Council. Perhaps you serve on a Finance Council. This qualified sounding board and planning apparatus is essential for the success of Catholic Schools. We’d love to hear from you if you serve on a Finance Council, or want to share about how wonderful your resources are.

Diocesan Standards

One of the first things to look into is what your Diocesan Standards are. If you’re not sure, call your Diocesan Finance Department and ask them to direct you to their Fiscal Year recommendations. Is there a recommended percentage of Public School salaries that you are encouraged to meet? How close are you to the recommended margins? Would an incremental increase in tuition make it possible for you to incrementally reach those goals?

Deciphering the Public School Salary Schedule

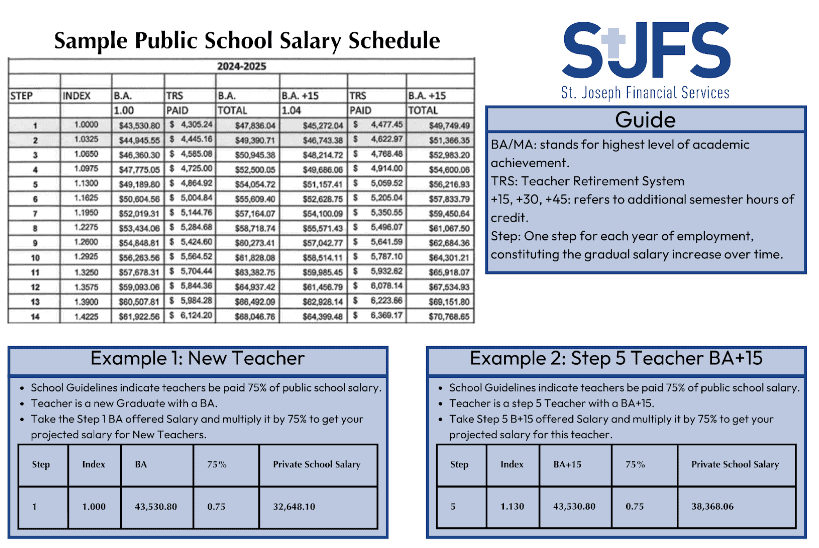

Public Schools publish their Salary Schedule every few years, as part of the financial transparency due from being a public entity. In Google, you can search for your district with the words “Salary Schedule.” Most of the time it is available as a PDF, and it will cover a range of years, for instance FY23-FY25. (Fiscal Year)

Navigating to the portion, which includes Salary Steps for Public School Teachers, use this information for each of your Private School teachers to ensure that their salary increase for the next fiscal year is set at the percentage agreed upon by your school administration and finance council. We will offer an example.

Public Schools offer a Step system, where each Step represents a year of employment. An increase index is offered for each salary step. The next indicator is the degree held by the teacher; BA or MA. When we see TRS, this indicates the Teacher Retirement System. For teachers who have a BA and who have continued their studies to +15 credit hours, there is an increase for this as well. Likewise with an MA there are increases for +15, +30, +45, +60, and +75 for additional credit hours achieved.

Using the guidelines put forth by your diocese, the insight of your school administration as well as the wisdom of your finance council determine the percentage of the public school salary you are able to offer your teachers. Multiply the offered public school salary by your offered percentage to calculate the given teacher’s salary for the next fiscal year.

Review

The review process is the most important step after your initial calculations. Using the total salary commitments projected for the next school year, compare this to the projected tuition income. Salary calculations really ought to happen ahead of the setting of tuition and the two should be done in tandem. However, it’s never too late to start a review process like this.

If you’d like to go a step further, go through your existing staff and calculate the Employer contributions to Social Security/Medicare, Health Benefits, and 401k matches, based on the current enrollment. The closer you can get your figures to an accurate projection of the next school year, the more confident your school can be in approaching the new school year. Recruiting new teachers, and also reminding your current teachers of their importance and your intentions to continue investing in them. Retaining skilled teachers sets your school apart from the public school system, let us help you achieve your goals.